In this article, we will be discussing how to outsource bookkeeping to the Philippines, as well as, other alternatives. We will also take a look at different reasons you may want to outsource, positive and negative things to consider when outsourcing your bookkeeping, what is involved, what you can expect, what you can’t expect, and timing.

Phew… that was a lot just in the description. Don’t worry, I will make it a breeze for you. By the time you are done reading this, you will be an expert in this area. Okay, let’s get to it.

In its simplest form, outsourcing is taking a task that you have and giving it to another person or company to complete. Before the internet, we did this by hiring CPA down the block to do our taxes.

Today we have a lot more options. With all the awesome tools and technology we have today, it is just as easy to have someone working for you across the globe as it is to have them working in the cubicle next to your office.

One of the biggest concerns business owners face in an accrual-based accounting and bookkeeping system is all the manual data entry. Let’s be honest… this is a pain in the butt and you probably don’t want to spend all your time entering the data yourself or paying someone $20/hr to do it for you.

This is where outsourcing to a company/employee (we will get to this in a minute) in another country can be hugely beneficial. It will save you time, stress and is easy on your wallet. You can hire a certified bookkeeper for about $4-$5 bucks an hour. Most of them will even have their CPAs and are very familiar with GAAP accounting standards. Hard to believe, but it is true.

You will still need to keep an eye on your finances, but you won’t have to do it yourself or spend a fortune getting this accomplished. Also, when you implement an automated bookkeeping system this will make it very easy for you to see exactly what is going on financially with your business.

When you outsource your business bookkeeping activities, you will find that there are fewer resources you need to worry about. An outsourced employee will be responsible for their own computer, internet, software, and workspace. This will save you time, headaches and cost-expenses, which you can then put directly back into other areas of your business.

One advantage to note about hiring an outsource company vs an employee is that you will not be responsible for hiring or training that new person. You just make a call or send an e-mail… boom the process is started. It almost immediately will begin being removed from your plate.

There are a few disadvantages to this, but we will go over them in the positive and negatives section below on which makes more sense, hiring an employee or outsource company.

Another major benefit of outsourcing is that all of your accounting and bookkeeping reports will be in a cloud-based environment. This means you can easily access your consolidated financial statements anytime and anywhere. It also means that your data will be updated in real time. As soon as it is entered by your virtual employee, the data will be at your fingertips.

We already briefly discussed this, and we will dive in a little deeper into the positive and negatives of employee vs outsource company another section. For now, let’s just say it is dramatically less expensive than hiring a traditional employee who comes into the office every day.

We already stated that you can hire a CPA or certified bookkeeper for about $4-$5 bucks an hour and are very familiar with GAAP accounting standards. If you simply want someone to do data entry and you don’t need them to know a lot about accounting that will cost you about $2/hr.

Allowing anyone into your financial data is scary, but add the layer of it being a stranger halfway across the world… that can be downright terrifying. Luckily, cloud-based accounting systems make it very easy to lock down your data. This means your employees can only get to the information/data you give them access to.

CPAs are professionals in any area of the world. They have taken a vow of ethics. Filipinos are also very loyal and trustworthy. However, I would still recommend you make all employees sign a confidentiality and non-disclosure statement. If you are hiring a company, I would make sure that the company requires a confidentiality and non-disclosure statement from all of its employees as well.

Time is one thing that we can never get enough of. It always seems like there is more to accomplish than hours in the day. Offloading the tasks of accounting and bookkeeping can quite literally give you back hundreds of hours each year. How can you put this time to better use?

Are you looking to hire a VA?

Click here if you’re looking for someone to work for you remotely.

This is a difficult question to answer because it is very individualized. If your accounting and bookkeeping records are currently a mess, it is going to take a lot of work to get everything set up correctly with a cloud-based accounting system. However, once it is completed your life will become much easier and you will wonder why you waited so long to do it. If things are already organized or you are already on a cloud-based accounting system it will be a much smoother and faster process.

Honestly, the best time is when you are looking for a way to reduce costs without compromising on accuracy. Making the switch will enhance your business operations and relieve a lot of the stress that goes along with tedious bookkeeping data entry.

You can expect to pay about twice the amount hiring an accounting company vs an employee. It will roughly cost around $100-$500 per month depending on the task and the level of expertise needed. A quick Google search will give you the most current top companies. At the time of this article, the top 5 auditing firms were:

Hiring an employee will cost between $3-$9/hr. This is significantly less expensive. Especially considering some of the $3/hr employees are CPAs or have around 9 years of experience in accounting. However, it will take time at first to get them up to speed on exactly how you like things done.

Also, you will need to manage them like any other employee. Typically they will not need a lot of training, but you must be prepared to step in and help them if they get stuck on something.

Here are just a few examples of people looking for you to hire them:

Hiring a bookkeeper vs. an outsourcing company

Honestly, it is the cost savings. India uses to be the place to go when outsourcing. Companies like Brickworks India had the corner market. However, when the book “The Four Hour Work Week” by Timothy Ferris was released prices skyrocketed. Because of his recommendations, the markets in India became very inflated due to the popularity and recommendation in the book.

Today, the Philippines is still a hugely untapped market. Most of their workforce is looking to be hired as an outsourced employee, which makes supply and demand very much in our favor. These are highly qualified people (with bachelor’s and master’s degrees from accredited colleges) dying to become a part of your team. Stable work is not easy in the Philippines, so when you find a good employee you will discover they are incredibly loyal and hardworking. They are very eager to take ownership of their work and view your company environment as almost family.

For you to be able to have a virtual employee or company, you will need to adopt cloud accounting software. MYOB, Quickbooks, SASSU, and Xero are the most universally used. Make sure you check with the company or employee to ensure they are familiar with the accounting software you are using.

You will need to provide the company or employee with a non-disclosure and confidentiality agreement to protect your company. Also, you will want to make sure you put the appropriate permissions on each user who accesses your accounting software.

Any paper receipts that you have will need to be scanned and e-mailed or uploaded to the software for a virtual employee or company to be able to process the data. If this is something you will hate, or worse just won’t do, it is better to hire a local employee where you can just place the receipts on their desk.

If you are thinking about hiring a company, I gave you 5 really good options under the cost of the accounting section. Here they are again for your convenience:

If you are thinking about hiring an employee, I would highly recommend OnlineJobs.ph. This is where I have hired all of my employees and have had terrific results. You can check them out here.

Please know that this link is an affiliate link and I will get a commission if you do hire someone through them. The cost is exactly the same to you, so you could just go to onlinejobs.ph directly if you felt uncomfortable with me getting that commission. However, that link does help me continue to keep this site alive, so I would greatly appreciate it if you did use my link. To find out more about our view on affiliate products, please see this page.

Hopefully, this article has given you enough value that you don’t think I am just simply trying to sell you something. I will only recommend things that have worked well for me. PS) Other sites would pay me more to recommend their options, but I simply don’t think they are as good as Onlinejobs.ph. Hence why I won’t recommend them. Okay, enough about that.

Each employee/company will have different qualifications just like in the USA, Canada, England or Australia. However, most of the employees looking to be hired or working for an outsourcing company will have:

Honestly, this will depend on many factors. If you already have an online accounting system this will be a breeze and shouldn’t take more than a couple of hours to research the right company based on price and service.

If you are going to hire an employee to add a few more hours to sift through resumes and interview your top 10 candidates (Check out our article on the best way to interview a virtual employee).

If you don’t have an online accounting system it is going to take longer to get everything set up. Expect it to be a pain in the butt even if you do outsource the entire process to a company to build it for you from the ground up. You are still responsible to give them all the data to enter into the software. Remember, garbage in equals garbage out.

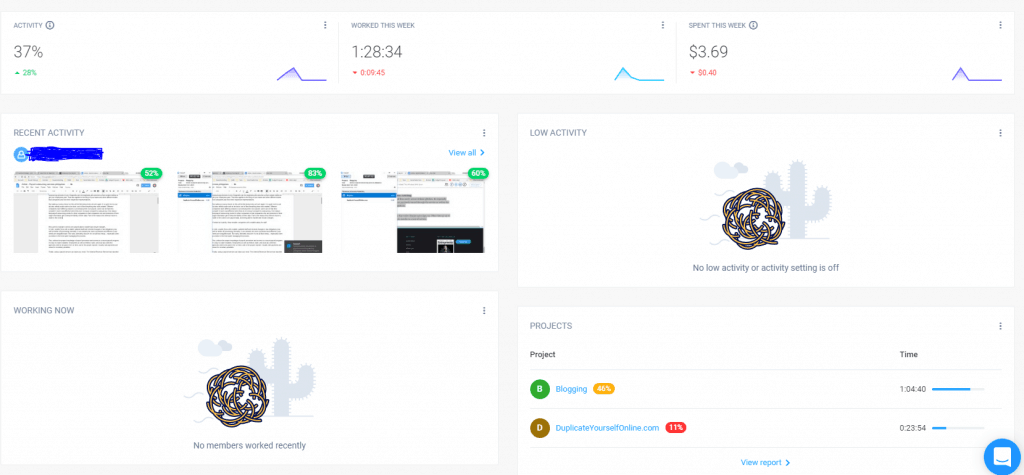

If you decide to hire an employee, I would highly recommend using time tracking software. There are several really good options out there such as RescueTime, TimeProof, and HubStaff.

Personally, I use Hubstaff because it is comparatively priced and takes screenshots every few minutes of the employee’s monitor. You will be able to see exactly what they are doing, view all the websites and programs they have accessed, as well as setting up time limits (example: not more than 20 hrs per week).

You can also pay your employees right from Hubstaff. It makes it very easy to know they are working efficiently, as well as, paying them for exactly the amount of time they worked. In my experience, if an employee is not willing to use tracking software it typically means they don’t want you to see what they are doing. This is a huge red flag for me.

Hubstaff costs about $6-$9 per employee per month (depending on your plan) and in my opinion, it is worth every dime. It makes things super easy and gives you that added level of security.

Again, Hubstaff is an affiliate link, so I will get a commission if you decide to use them. You will actually get a 10% discount using my link, but again if you are not comfortable with that feel free to just go to HubStaff.com directly. I would greatly appreciate it if you did use my link, and it has a free trial for you to check out to make sure it works well for you.

Regardless of whether you hire a company or an employee, you will still need to know what is going on in your business. This is not exactly a set it and forget it type thing.

It is true that outsourcing your bookkeeping to the Philippines will dramatically reduce your time and stress level, but at the end of the day, it is your company and your butt on the line.

So, make sure you do take a few minutes each week to review the data. A second set of eyes never hurts. We are all human and it is much easier to find a mistake in one week’s work vs. finding it one year later.

Outsourcing your bookkeeping to the Philippines can be a very cost-effective way to grow your business. It will free up your time and will keep overhead costs down. You can choose to hire a company or an individual employee to take care of all your data entry and accounting work.

To do this, you will need to convert to a cloud-based accounting system. You will want to make sure you have the company or employee sign a confidentiality and non-disclosure agreement.

Hiring a company typically has a monthly retainer of $100-$500 per month, while a good employee will cost about $3-$9 an hour. Time tracking software is highly recommended to ensure your employee/company’s efficiency and correct billable hours. It also will allow you to see the programs, websites, and data they have accessed.

At the end of the day, you are still responsible for all areas of your business. So, keep an eye on the financials. Even with this in mind, it still makes a lot of sense to outsource this part of your business to someone else. The time, freedom and stress relief you will get from this is totally worth it.

Want to hire your own VA?

Click here to find amazing talent waiting to work for you.